With the year 2024 just around the corner, we understand the importance of finding a Budget Direct Car insurance review.

In this review at ktktld.edu.vn, we’ll delve into the ins and outs of their policies, assess their coverage, how to register and more.

Let’s dive in and discover if this insurance is the right choice for you!

Contents

- 1. Summary of Budget Direct Insurance

- 2. What is Budget Direct Insurance?

- 3. Pros of Budget Direct Online Car Insurance

- 4. Cons of Budget Direct Insurance Car

- 5. Budget Direct Car Insurance Quote

- 6. Budget Direct Auto Insurance Requirements

- 7. Guide to Register Budget Direct Car Insurance Step-by-step

- Step #1: Visit the Budget Direct Website

- Step #2: Choose the Type of Insurance

- Step #3: Agree to the Terms and Conditions

- Step #4: Provide your Car Details

- Step #5: Review the Cover

- Step #6: Proceed to Review your Car

- Step #7: Provide your Personal Details

- Step #8: Supply the Additional Information

- Step #9: Follow the Remaining Prompts

- 8. Budget Direct Car Insurance Reviews

- 9. Feedback of Budget Direct Insurance Car

- 10. Budget Direct Insurance Claim

- 11. Compare to Types of Budget Direct Insurance

- 12. Budget Direct Car Insurance Contact Number

- 13. FAQs – Budget Direct Car Insurance

- 14. In Conclusion

1. Summary of Budget Direct Insurance

| ✅ Review | ⭐ Budget Direct Car Insurance |

| ✅ Guide to | ⭐ Register for Budget Direct comprehensive car insurance |

| ✅ Quote | ⭐ $200 – $500 |

| ✅ Age | ⭐ At least 18 years old |

| ✅ Pros | ⭐ Competitive Pricing, Online Convenience |

| ✅ Cons | ⭐ Limited Coverage Options |

| ✅ Evaluate the effectiveness | ⭐ Good |

| ✅ Feedback | ⭐ Read more in this article |

| ✅ Phone number | ⭐ 1300 306 560 |

| ✅ Insurance Plan | ⭐ Comprehensive, Third party |

2. What is Budget Direct Insurance?

Budget Direct Insurance is an insurance provider that operates in various countries, including Australia and Singapore. They offer a range of insurance products, primarily focusing on car, home, and travel insurance. Budget Direct is known for providing competitive rates and straightforward coverage options to its customers.

3. Pros of Budget Direct Online Car Insurance

Here are some of the potential pros of Budget Direct online car insurance:

- This provider is often praised for its competitive pricing and cost-effective car insurance options.

- As an online insurance provider, it offers a straightforward and user-friendly process for obtaining quotes, purchasing policies, and managing policy details online.

- Its online platform often provides access to 24/7 customer support.

- It may offer various discounts, such as multi-policy discounts, safe driver discounts, and discounts for insuring multiple vehicles.

4. Cons of Budget Direct Insurance Car

Here are some potential cons of Budget Direct car insurance:

- This insurer may offer fewer coverage options compared to other insurance providers.

- While it may provide competitive rates initially, there have been instances where premiums increased significantly upon Budget Direct car insurance renewal, catching policyholders off guard.

- Some customers have faced challenges during the claims process, encountering delays or difficulties in receiving proper compensation for their claims.

- This provider may have a limited selection of add-on coverages.

5. Budget Direct Car Insurance Quote

| Insurance Type | Price |

| Budget Direct Comprehensive Car Insurance | $500 |

| Budget Direct Third Party Car Insurance | $200 |

6. Budget Direct Auto Insurance Requirements

To qualify for Budget Direct insurance car, you need to meet certain requirements as follows:

- You must have a valid driver’s license issued by the appropriate authorities in Australia.

- Your car must be registered and have a valid license plate.

- This insurer has age restrictions for certain types of coverage or policies, but at least 18 years and above.

- You’ll need to provide accurate details about your vehicle, such as make, model, year, and vehicle identification number (VIN).

- You may need to specify how you plan to use your vehicle (e.g., for personal use, business use, or both).

- If you have a history of safe driving with no claims made, you may be eligible for a no-claims bonus or discount.

- You’ll need to provide your current address and contact details.

- You’ll be required to set up a payment method to pay for your insurance premium.

7. Guide to Register Budget Direct Car Insurance Step-by-step

Here’s a step-by-step guide to registering for Budget Direct Car insurance:

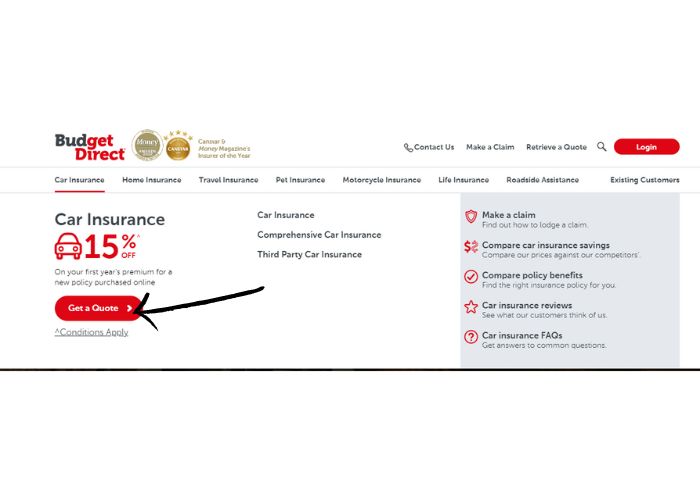

Step #1: Visit the Budget Direct Website

- Go to the official Budget Direct website using your web browser.

Step #2: Choose the Type of Insurance

- Once you’re on the Budget Direct website, navigate to the insurance section and choose the type of insurance you want to register for.

- Press “Get a Quote” and you will be redirected to a Terms and Conditions page.

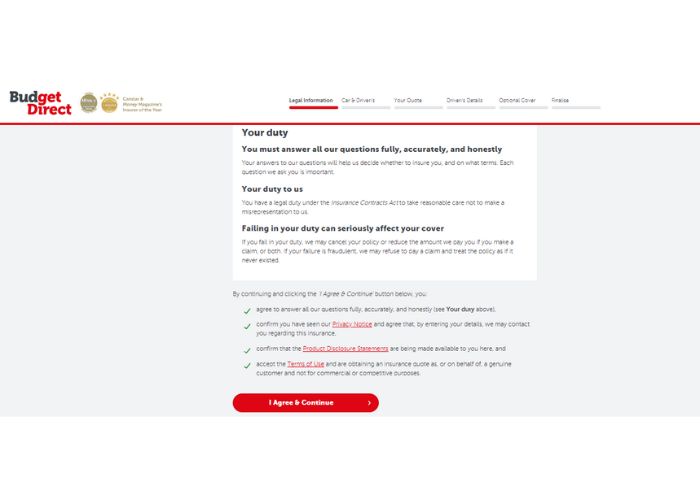

Step #3: Agree to the Terms and Conditions

- Click the “I Agree & Continue” button to continue.

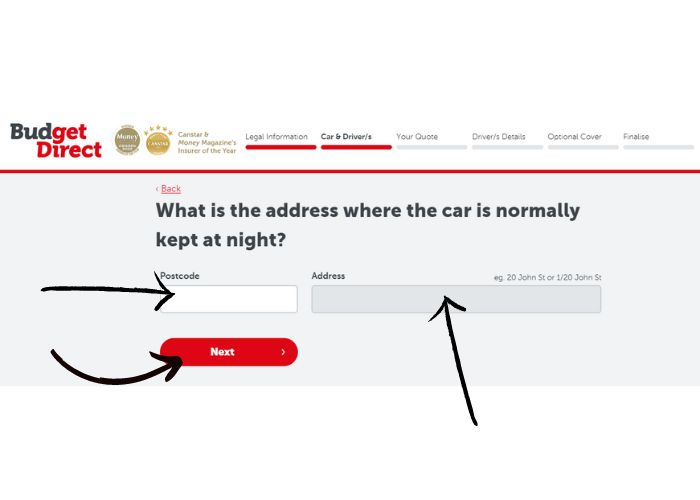

Step #4: Provide your Car Details

- Provide all necessary information about your car such as address, brand, etc.

- Then choose the level of cover

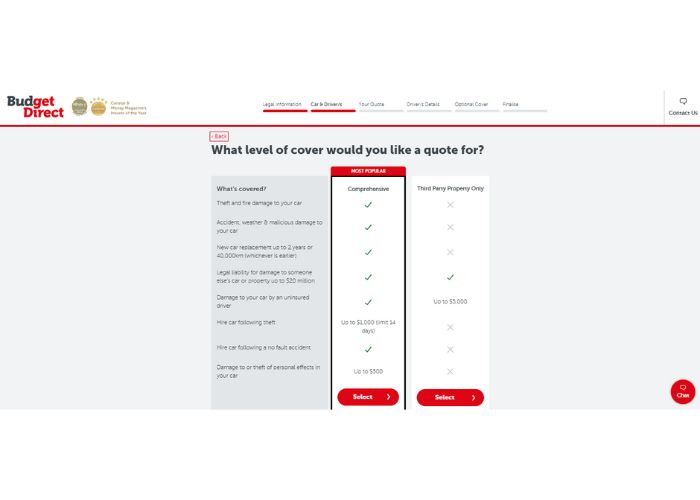

Step #5: Review the Cover

- Budget Direct will generate a quote based on the information you provided.

- Take the time to review the coverage, premium, and any optional add-ons available.

Step #6: Proceed to Review your Car

- Provide the rest information about the current situation of your car.

Step #7: Provide your Personal Details

- Fill in your First Name (optional), Date of birth and gender.

- Click “Next” to continue.

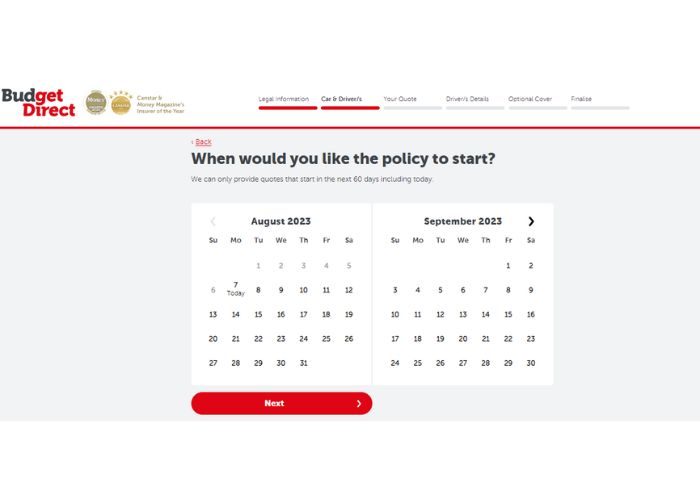

Step #8: Supply the Additional Information

- Continue providing all the required information in the next pages.

- Then choose the date to start the policy.

Step #9: Follow the Remaining Prompts

- Fill in your email address and then press “Next”.

- After that, adhere to the following instructions given on the webpage to finish registering for Budget Direct Insurance.

8. Budget Direct Car Insurance Reviews

The thoughts about this insurance are quite positive. The name itself suggests that they focus on providing budget-friendly insurance options, which is appealing to a cost-conscious consumer.

Budget Direct has a wide range of insurance products available, including car insurance, home insurance, travel insurance, and more. This comprehensive offering gives us the flexibility to cover different aspects of our life under one provider, which is convenient and potentially cost-effective.

Budget Direct seems to have a user-friendly website and app, making it easy to manage my policies and access information.

For Budget Direct comprehensive car insurance review, check the videos below:

9. Feedback of Budget Direct Insurance Car

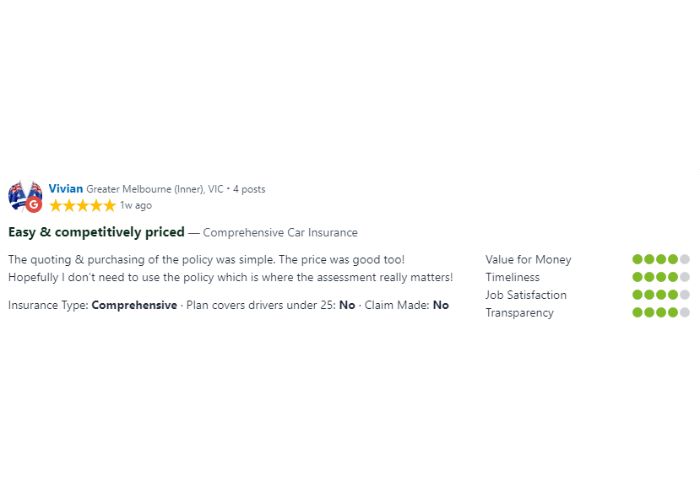

Budget Direct Car Insurance generally receives positive feedback from its customers. Many customers appreciate the competitive pricing and value for money that Budget Direct insurance offers.

The ease of purchasing insurance online and the efficient claims process are also mentioned as commendable aspects of their service.

Customers have also mentioned the helpfulness and professionalism of the staff when dealing with inquiries or claims.

However, some customers have expressed concerns about the limited coverage options and the level of customer service provided in certain instances.

- MelbourneDudeAU, had a Budget Direct car insurance review Reddit 10 months ago: “Budget Direct is regularly winning awards and I’ve not had a problem since switching. I’ve also never claimed while being with them though, which is where most people will have issues. Insurance claims are never straightforward and I imagine at the moment with supply chain issues, people are waiting a long time for repairs.”

- Vivan reviewed one week ago: “The quoting & purchasing of the policy was simple. The price was good too! Hopefully I don’t need to use the policy which is where the assessment really matters!”

10. Budget Direct Insurance Claim

To file a Budget Direct Car insurance claim, follow these steps:

Step #1: Gather Information

- Before you start the claim process, make sure you have all the necessary information handy.

- This may include your policy number, contact details, details of the incident, and any relevant documents like photos or receipts.

Step #2: Contact Budget Direct

- You can initiate the claim process by contacting Budget Direct.

- You can call the Budget Direct claims department using the phone number and a claims representative will guide you through the process.

- Make Budget Direct car insurance login on their website, if you have one, and find the claims section.

Step #3: Provide Details

- When you speak with a claims representative or submit your claim online, be prepared to provide all the relevant details about the incident.

- This could include the date, time, location, and a description of what happened.

Step #4: Submit Supporting Documents

- Depending on the type of claim you’re filing, you may need to submit supporting documents.

- If it’s a property insurance claim, you might need repair estimates or receipts for damaged items.

Step #5: Cooperate with the Investigation

- Budget Direct may need to investigate the claim before processing it.

- Be cooperative and provide any additional information they request.

Step #6: Wait for Claim Approval

- Once your claim is submitted and all the necessary information is provided, Budget Direct will assess your claim and determine whether it’s covered by your policy.

Step #7: Claim Settlement

- If your claim is approved, Budget Direct will provide the appropriate settlement based on the terms of your insurance policy.

- The settlement could involve repairs, replacements, or financial compensation, depending on the nature of the claim.

11. Compare to Types of Budget Direct Insurance

| Criteria | Comprehensive Insurance | Third Party Insurance |

| Cover for Damage | Covers damage to your own car as well as other peoples’ cars if an accident occurs | Covers damage caused by your car to other peoples’ cars only |

| Fire & Theft | Typically covered | Third Party Fire & Theft insurance covers this, but basic Third Party Only Insurance does not |

| Vehicle Age Limit | Offers comprehensive plans for cars up to 15 years old | Offers coverage for vehicles up to 30 years |

| Buy Online Discount | Potential to save 15% off the first year’s premium | Potential to save 15% off the first year’s premium |

Sources: Refer to The Australian reporting and research

12. Budget Direct Car Insurance Contact Number

To contact or make Budget Direct car insurance complaints, you can reach them through various channels:

- Phone number: You can call their phone number 1300 306 560.

- Address: If you prefer to speak in person, you can also visit their office address 13/9 Sherwood Road, Toowong 4066.

- Email: you can send them an email to their provided email address hello@budgetdirect.com.au

Remember to have your policy details handy when contacting them for a quicker and more efficient response.

Read more:

- Tick Travel Insurance

- 1Cover Travel Insurance

- Medibank travel insurance

- 10 Cheapest car insurance in Sydney

- Bingle car insurance review

13. FAQs – Budget Direct Car Insurance

To understand more about Budget Direct insurance, read the FAQs below:

Is Budget Direct car insurance good?

This car insurance is generally considered good due to its competitive pricing, comprehensive coverage options, and excellent customer service. It offers various benefits such as no-claim discount protection and 24/7 claims support. However, individual experiences may vary, so it’s recommended to compare quotes and read reviews before making a decision.

How to cancel Budget Direct car insurance?

To cancel your car insurance, you should contact customer service at 1300 306 560. Ensure to provide your policy information and reasons for cancellation. Budget direct car insurance cancellation fee may apply as per your agreement. Do note cancellation only becomes effective after confirmation from Budget Direct.

How much is Budget Direct car insurance?

This car insurance cost varies based on multiple factors like location, coverage options, and driver’s details. However, they offer a nationwide roadside assistance service at $89.95 per year. So, it’s best to directly visit Budget Direct’s website or contact them for a personalised quote that accurately reflects your specific circumstances.

14. In Conclusion

Budget Direct Insurance proves to be a viable option for those seeking affordable and convenient insurance solutions.

With competitive pricing, customizable policies, and a user-friendly online platform, it caters to the needs of cost-conscious consumers.

Positive customer reviews further reinforce its reputation as a reliable provider.

However, potential customers should consider the limited coverage options and occasional customer service concerns.

The details you provided about Budget Direct Insurance are so informative. This helps me understand more about this insurance.

Is it necessary to make Budget Direct car insurance to file a claim? I want more information about it.

Wow, the policy for Budget Direct car insurance renewal is easy to process. Thank you for letting me know!