Looking for a quick and convenient way to borrow money in the Philippines? Tonik might be your answer. As the first licensed digital bank in the country, Tonik offers a hassle-free loan application process with competitive rates. But is it the right choice for you?

This Tonik Loan review Philippines will explore the key features, pros and cons, and everything you need to know before applying.

Contents

What is Tonik app?

Tonik app is a mobile application for a neobank in the Philippines. Here’s a breakdown of what that means:

- Neobank: Tonik operates entirely online, without physical branches like traditional banks. It’s convenient and accessible from anywhere with an internet connection.

- Mobile App: All account management and transactions are done through the Tonik app, offering a user-friendly experience.

Tonik Loan Review Philippines

Key Features

- 100% digital loan application: Apply for a loan anytime, anywhere through the Tonik mobile app.

- Fast loan approval: Get a decision within minutes.

- Competitive interest rates: Rates start as low as 4.24% monthly add-on interest.

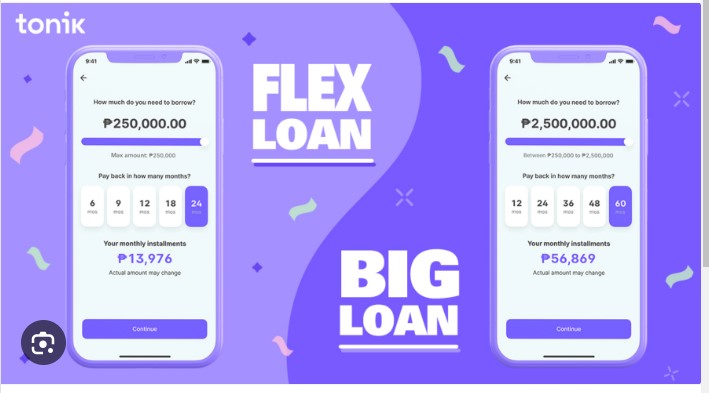

- Flexible loan terms: Choose a repayment term that fits your budget (6, 9, or 12 months).

- Transparent fees: No hidden charges, you’ll see the total loan cost upfront.

- Approval time: Tonik advertises their “Quick Loan” product with approval times as fast as within minutes upon submitting your application.

Pros

- Easy and convenient application process

- Fast loan approval

- Competitive interest rates

- Transparent fees

- Secure platform

Cons

- Relatively new company compared to traditional banks

- Limited loan amount (up to ₱50,000)

- App-based platform might not be ideal for everyone

Tonik complaint Philippines

While Tonik is generally well-regarded, there have been occasional complaints regarding interest rate calculations and customer service response times. It’s important to carefully review the loan terms and conditions before applying.

Is Tonik loan Legit?

Absolutely. Tonik is a registered digital bank with the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines. Their registration number is BSP Registration No. BSP DC 2020-020.

Tonik loan interest rate Philippines

Tonik offers competitive interest rates, with estimates starting as low as 4.24% monthly add-on interest. However, the actual rate you receive will depend on your creditworthiness and loan term.

How to Apply for a Tonik Loan

Eligibility Requirements:

- At least 20 years old

- Filipino citizen with valid Philippine ID

- Regular source of income

Step-by-Step Application Guide:

- Download the Tonik mobile app from the App Store or Google Play Store.

- Create an account and complete your profile.

- Choose your desired loan amount and repayment term.

- Review the loan offer and submit your application.

- You will receive a decision within minutes.

- If approved, the loan amount will be credited to your Tonik account.

Required Documentation:

- Proof of income (payslips, bank statements, etc.)

- Valid government-issued ID

Who Should Consider Tonik Loan App?

The Tonik Loan App Philippines is ideal for individuals who need a quick and easy way to borrow a small amount of money for short-term needs. It’s a good option for those with a good credit history who are comfortable managing their finances through a mobile app.

Tonik loan payment

Tonik loan payments are automated and deducted monthly from your Tonik account. Ensure you have sufficient funds to avoid late payment fees.

Alternatives to Tonik Bank Loan

Here are some alternatives to Tonik Loan:

- Traditional banks: Offer personal loans but may have a longer application process and higher interest rates.

- Peer-to-peer lending platforms: Connect borrowers with lenders directly, potentially offering lower interest rates but with higher risk.

- Credit unions: Offer loans to members with competitive rates and may be more flexible with loan terms.

Frequently Asked Questions

Is Tonik loan safe?

Yes, Tonik is a BSP-registered digital bank and uses secure technology to protect your information.

How long does Tonik approve loan?

Tonik typically approves loans within minutes.

What happens to unpaid Tonik loan?

Unpaid Tonik loans will incur late payment fees and may be reported to credit bureaus, negatively impacting your credit score.

Why does Tonik bank loan decline?

Tonik may decline your loan application for various reasons, including insufficient income, a poor credit history, or incomplete application information.

Conclusion

Tonik Loan offers a convenient and fast way to borrow money in the Philippines. However, it’s important to consider the interest rates, fees, and your individual financial situation before applying. Weigh the pros and cons and compare Tonik with other lending options to find the best fit for your needs.

Leave a Reply