As we approach the upcoming year 2024, the significance of locating a trustworthy insurance provider becomes apparent, one that provides competitive premiums and exceptional customer support is Bingle Car Insurance.

In this comprehensive evaluation at ktktld.edu.vn, we will thoroughly examine their policy details, evaluate the extent of their coverage, delve into the registration process, and more.

Join us in exploring whether this insurance option aligns with your needs and preferences!

Contents

- Summary of Bingle Car Insurance

- What is Bingle Car Insurance?

- Pros of Bingle Car Insurance

- Cons of Bingle Car Insurance

- Bingle Car Insurance Quote

- Bingle auto insurance requirements

- Guide to register Bingle Car Insurance Step-by-step

- Bingle Car Insurance reviews

- Feedback of Bingle Car Insurance

- Bingle Car Insurance claim

- Compare Bingle Auto Insurance to other companies

- Bingle Car Insurance contact number

- FAQs – Bingle Car Insurance

- Conclusion

Summary of Bingle Car Insurance

| ✅ Review | ⭐ Bingle Car Insurance |

| ✅ Guide to | ⭐ Register for Bingle comprehensive car insurance review |

| ✅ Quote | ⭐ $200 – $500 |

| ✅ Age | ⭐ At least 18 years old |

| ✅ Pros | ⭐ Competitive Premiums, Smooth Experience |

| ✅ Cons | ⭐ No In-person Support |

| ✅ Evaluate the effectiveness | ⭐ Good |

| ✅ Feedback | ⭐ Scroll down for details |

| ✅ Phone number | ⭐ Online Insurer – No phone number |

| ✅ Insurance plan | ⭐ Comprehensive, Third Party |

What is Bingle Car Insurance?

Bingle Car Insurance is a streamlined and user-friendly option for auto coverage. It provides essential protection for your vehicle and offers a straightforward claims process. With Bingle, you can enjoy peace of mind knowing that your car is insured in case of unforeseen events, all supported by their efficient online platform.

Pros of Bingle Car Insurance

Here are some amazing benefits for Bingle Auto Insurance Quote:

- Affordability: Bingle often offers competitive premiums, making it an attractive choice for budget-conscious individuals.

- User-Friendly Experience: Its online platform simplifies policy management and claims, providing a hassle-free process.

- Quick Claims Process: Bingle is known for its efficient claims handling, ensuring a smooth experience during stressful times.

- No-Frills Coverage: The straightforward coverage options cater to those seeking essential protection without unnecessary extras.

Cons of Bingle Car Insurance

Alongside with the pros above, there are some drawbacks for bingle car insurance renewal:

- Limited Coverage Options: Bingle’s focus on simplicity might lead to fewer customizable coverage options compared to some competitors.

- Exclusions and Limits: Like any insurance, Bingle has exclusions and limits that could leave some incidents or expenses uncovered.

- Customer Service Availability: While the online experience is smooth, some customers have reported challenges with reaching customer service when needed.

- No In-Person Support: Bingle operates solely online, which might not suit individuals who prefer face-to-face interactions for their insurance needs.

Bingle Car Insurance Quote

There are two types of insurance quotes Bingle:

|

Types of insurance |

Quote |

|

Bingle Comprehensive Car Insurance |

$500 |

|

Bingle Third Party Property Damage Insurance |

$200 |

Bingle auto insurance requirements

To be accepted for Bingle Car Insurance, there are some requirements that you need to meet:

- Vehicle Criteria: Your car should meet Bingle’s acceptable criteria for age, condition, and usage.

- Driver’s License: You must hold a valid driver’s license recognized in your jurisdiction.

- Age Requirement: Generally, drivers between 18 and 100 years old are eligible.

- Residency: You should be a resident of Australia.

- No Unacceptable History: Bingle may assess your driving and claims history to determine eligibility.

- Purpose of Use: The car should be for personal use, not commercial purposes.

- Honest Disclosure: Provide accurate information during the application process.

- Payment: Ensure the premium payment method is acceptable to Bingle.

- Acceptance of Terms: Agree to Bingle’s terms and conditions.

- Online Access: You should have access to the internet for policy management and claims.

Guide to register Bingle Car Insurance Step-by-step

Here are the steps you may want to follow for your registration at Bingle Car Insurance:

Step #1: Visit the official website of Bingle

- Bingle car insurance log in via: https://www.bingle.com.au/

- Or search for “Bingle Car Insurance” on your favorite browser.

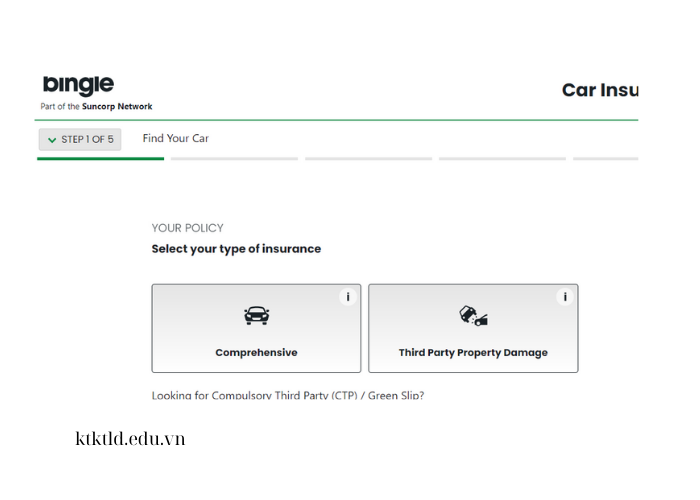

Step #2: Choose a type of insurance

- Once you pressed the “Get a Quote” button, it will lead you to the steps that you will follow.

- Select your type of insurance (Comprehensive or Third- Party Property Damage).

Step #3: Agree to terms and conditions

- Click the “I understand” button and continue.

Step #4: Finding your car

- You can choose “By registration” or “By Make and Model”.

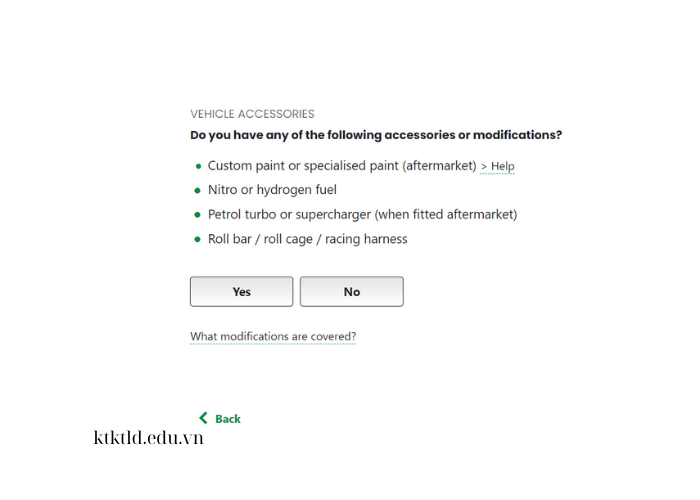

Step #5: Provide your Car Features

- Click “Yes” if your car has any of the custom paint, nitro fuel, petrol turbo or roll bar, otherwise click “No”.

- Choose the color of your vehicle.

Step #6: Car Details

- You will provide answer about your car’s financial status, history, usage, annual kilometers, day time parking, etc.

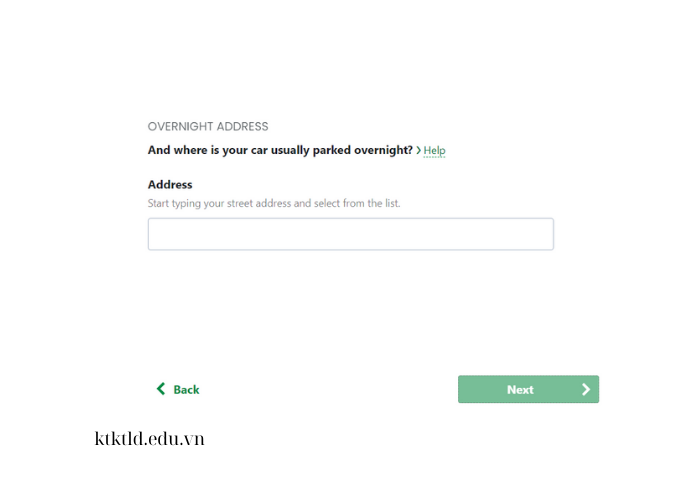

Step #7: Following Next Instruction

- Fill in your overnight parking address and then click “Next”.

- After that, keep following guidelines to complete your quote.

Bingle Car Insurance reviews

- Such a great program for drivers to select their own vehicle’s benefits. I personally recommend choosing this insurance because you never know what’s going to happen to your car and that is the way to go.

- If you are thinking of getting an insurance for your car, it will be a good choice at Bingle.

For Bingle Car Insurance Reviews, check this video below:

Feedback of Bingle Car Insurance

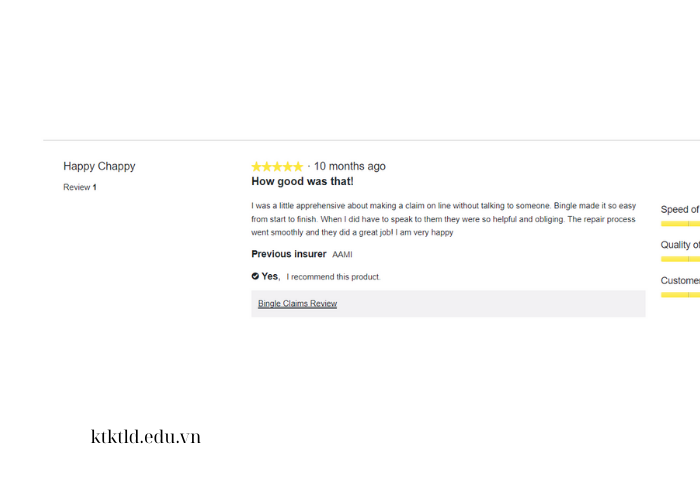

Feedback regarding bingle car insurance renewal has generally leaned towards the positive side. Many policyholders have lauded the insurer’s comprehensive coverage and prompt claims processing.

Users express contentment with Bingle’s customer service quality, often deeming the company reliable and trustworthy. However, a few unfavorable reviews have surfaced, primarily citing insurance pricing and occasional challenges with claim approvals.

- Happy reviewed 10 months ago: “I was a little apprehensive about making a claim on line without talking to someone. Bingle made it so easy from start to finish. When I did have to speak to them they were so helpful and obliging. The repair process went smoothly and they did a great job! I am very happy”.

- Naqvi reviewed 11 months ago: “Bingle insurance is very good seriously I am with bingle more than 6 years but very happy very helpful thanks”.

Bingle Car Insurance claim

To make a Bingle Car Insurance claim, you can follow these steps below:

- Step #1: Contact Bingle by reaching out online or via phone.

- Step #2: Provide Details by sharing incident information.

- Step #3: Collect Evidence with photos, reports, etc.

- Step #4: Complete Form by filling out Bingle’s claim form.

- Step #5: Submit Documents and send via provided channels.

- Step #6: Bingle reviews and investigates assessment.

- Step #7: Bingle processes payment if approved.

- Step #8: Vehicle Inspection (if needed) for assessment of damages.

- Step #9: Finalize claim settlement.

- Step #10: Review and feedback if required.

Compare Bingle Auto Insurance to other companies

| Factors | Bingle Car Insurance | Swiftcover | Protecta Insurance |

| Pricing | Offers competitive premiums, targeting cost-conscious customers. | Known for competitive pricing and online discounts to attract budget-minded policyholders. | Strives to provide cost-effective options while catering to various budget ranges. |

| Online experience | Provides a user-friendly online platform for policy management and claims. | Specializes in online services, allowing customers to handle policies and claims digitally. | Offers online services for convenient policy handling and claims processing. |

| Coverage option | Offers simplified coverage options without overwhelming choices. | Provides a range of coverage levels, allowing customers to tailor plans to their needs. | Presents a variety of coverage levels and options to accommodate different needs. |

Sources: Refer to The Australian reporting and research

Bingle Car Insurance contact number

You can find out Bingle Insurance phone number or other contact information below:

- Phone number: Bingle Car insurance does not have a phone number since Bingle is an online insurer.

- Email: myclaim@bingle.com.au.

- Address: Bingle’s home is at Level 23, 80 Ann Street, Brisbane QLD 4000 Australia

Read more:

- Budget Direct Insurance reviews

- 10+ Best Cheapest Car Insurance Sydney Compare Companies

FAQs – Bingle Car Insurance

You may look down to the FAQs below to understand more about Bingle Car Insurance.

Is Bingle car insurance good?

Bingle car insurance is widely recognized not only for its highly competitive rates but also for its unwavering commitment to providing customers with straightforward and easily understandable coverage. Its efficient claims process further adds to its appeal, making it a top choice for those who prioritize both value and efficiency in their insurance provider.

How to cancel Bingle car insurance?

To initiate the cancellation of your Bingle car insurance policy, it’s advisable to contact their dedicated customer service team through the provided phone line or their user-friendly online portal. By following their well-defined cancellation process, which includes adhering to any stipulated notice period and providing essential policy details, you can smoothly complete the cancellation procedure.

Who owns Bingle insurance?

Bingle car insurance proudly falls under the ownership of the esteemed Suncorp Group, a leading financial services provider within Australia. Leveraging the support and resources of such a reputable parent company underscores Bingle’s commitment to delivering reliable coverage and exceptional service to its policyholders effectively.

Why is Bingle car insurance so cheap?

The affordability of Bingle car insurance is attributed to its strategic cost-effective approach. By offering streamlined services that focus on essential coverage components, Bingle ensures that customers receive the protection they need without unnecessary frills, ultimately resulting in competitive pricing that resonates with budget-conscious individuals seeking quality coverage.

Does Bingle car insurance have an app?

As of my last update in September 2021, Bingle did not provide a mobile app. Instead, their website offered a user-friendly platform for tasks like policy management and claims. For the most current information about the availability of a mobile app, it’s advisable to refer to their official resources.

Conclusion

In conclusion, Bingle Car Insurance stands out as an attractive choice for individuals seeking cost-effective coverage with a user-friendly experience.

Its competitive premiums, straightforward policies, and efficient claims process make it a popular option.

While some limitations exist, Bingle’s positive reputation, commitment to simplicity, and reliable service position it as a viable solution for those looking for essential and affordable car insurance.

As circumstances can change, it’s advisable to review Bingle’s current offerings for the most accurate assessment.

I was kind of worry if about my Bingle car insurance renewal, but thanks to this post things went easier

I did not know where to start Bingle car insurance log in, until this post came up. Thanks!

Great tips to find out specific Bingle auto insurance quote.