You’re looking for Wise Loan reviews, but you’re not sure if they’re real and safe. Stop looking!

In this blog at ktktld.edu.vn, We’ll give you an honest review that takes into account your worries about safety, legitimacy, and any possible problems.

Keep reading to learn everything you need to know about this trusted brand!

Contents

- Summary of Wise Loan

- What is Wise loan?

- Pros and cons of Wise loan

- Wise credit loan interest rate

- Example of Wise loan calculation

- Wise loan requirements

- Wise loan Amounts

- Guide to register Wise loan Step-by-step

- Reviews on Wise loan app and feedback

- Wise loan loan repayment

- Compare Wise loan to other lending companies

- Wise loan customer service

- FAQs

- In Conclusion

Summary of Wise Loan

| ✅ Reviews | ⭐ Wise Loan |

| ✅ Requirements | ⭐ Active checking or savings account |

| ✅ Guide to | ⭐ Register for Wise Loan |

| ✅ Loan amount | ⭐ $2,00 – $20,000 |

| ✅ Pros | ⭐ Flexible repayment terms |

| ✅ Cons | ⭐ Late fees and prepayment penalties |

| ✅ Term | ⭐ 2 – 72 months |

| ✅ Phone number | ⭐ (800) 516-7840 |

| ✅ Effectiveness | ⭐ Good |

| ✅ Complants | ⭐ No |

What is Wise loan?

Wise Loan is a company that gives out loans that are paid back over time. These loans can be used for many things, like accidents or costs that came up out of the blue. Wise Loan wants to help people with little or no credit background or a low credit score get loans.

Pros and cons of Wise loan

Wise loan reviews show that this lender brings its own pros and cons.

Pros

Wise loan app recommend its following benefits:

- Financial Flexibility: Loans can give you access to money right away when you need it, so you can pay for things or invest in chances.

- Structured Repayment: Most loans come with a set plan for how to pay them back, which makes it easier to set aside money each month for payments.

- Building credit: Repaying loans in a responsible way can help your credit past and credit score.

- Capital for Investments: Loans can give you the money you need to start a business or make an investment that could make you more money.

- Loan App fast approval

Cons

On the other hand, pointing out that the lender offers its borrowers many drawbacks related to wise loan application:

- Costs of Interest: Most loans have interest rates, which means you’ll pay back more than you took.

- Risk of Default: If you don’t pay back the loan when you said you would, it could hurt your credit score and lead to court action.

- Origination Fees: Some loans have fees that you have to pay up front, which cuts into the amount you get.

- Temptation to Spend Too Much: If you have access to loan money, you might be tempted to spend too much or buy things you don’t need.

Wise credit loan interest rate

The interest rate for an essential lending wise loan can range from 5.99% to 35.99% APR, depending on your credit score and other factors. The yearly percentage rate, or APR, includes both the interest rate and any fees that go along with the loan.

If you get a loan from Wise Loan, the APR will be in the triple digits or even the high triple digits. This will make your loan cost more in the long run, and if you can’t make your payments, it could put you in a loop of debt.

If you’re not sure you can pay back your loan right away, a Wise Loan may not be the best way to handle your money.

Example of Wise loan calculation

Here is an example of how to calculate a money Wise loan:

- Loan Amount: $10,000

- Interest Rate: 8% per annum

- Loan Term: 3 years (36 months)

Monthly Repayment Formula: Monthly Payment = (Loan Amount + Total Interest) / Number of Months

Step #1: Calculate Total Interest

- Total Interest = Loan Amount × Interest Rate × Loan Term (in years)

- Total Interest = $10,000 × 0.08 × 3 = $2,400

Step #2: Calculate Total Repayment

- Total Repayment = Loan Amount + Total Interest

- Total Repayment = $10,000 + $2,400 = $12,400

Step #3: Calculate Monthly Payment

- Monthly Payment = Total Repayment / Loan Term (in months)

- Monthly Payment = $12,400 / 36 = $344.44

In this example, if you were to take a $10,000 loan with an 8% annual interest rate and a 3-year repayment period, your monthly payments would be approximately $344.44.

Please note that this is a simplified example and doesn’t consider factors like compounding interest or potential fees.

Wise loan requirements

Wise loan requirements are as follows:

- Age: Minimum age is 18.

- Credit past and Score: When deciding if you are creditworthy, lenders look at both your credit past and your credit score.

- Income and job: Lenders want to make sure you have a steady source of income so you can pay back your loan.

- Debt-to-Income Ratio: Lenders look at your debt-to-income ratio, which is the amount of your income that goes toward paying off debts.

- Residency and Citizenship: Lenders may want borrowers to be legal residents or citizens of the country where the loan is being given.

- Documentation: When you apply for a loan, you’ll likely need to provide a number of papers, such as proof of income, bank statements, and maybe even tax returns.

- Loan Amount and Term: The amount you want to borrow and how long you want to pay it back can affect whether you meet the lender’s requirements.

Wise loan Amounts

Money Wise loan offers personal loans ranging from $200 to $20,000. Loan amounts start at $100 and go up in $500 increments.

The amount of money you may be able to borrow relies on your income, credit history, and where you live. It’s important to remember that the amount of your loan will also depend on how much you can afford and how the state regulates loans.

Guide to register Wise loan Step-by-step

Applying for a Wise loan is a simple process. You can follow the next instructions:

Step #1: Visit the Official Website

Go to the official Wise website. Make sure you are on the legitimate and secure website by checking the URL at: https://wiseloan.com/

Step #2: Apply for a loan

Type your information:

- Enter your email

- Select an amount

- Where do you live

Then click “apply now” button to move the next page

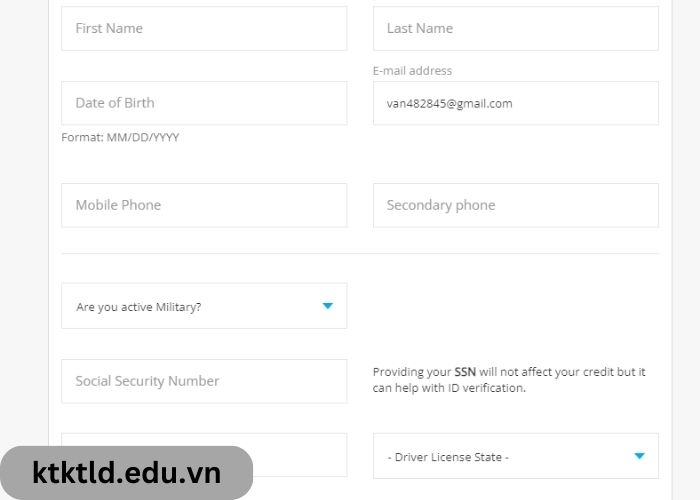

Step #3: Provide Personal Information

Fill out any required personal information, such as your name, date of birth, address, and contact details.

Step #4: Submit Documentation

Depending on the loan product, you might need to provide documentation such as proof of income, identification, and other relevant documents for Wise loan pre approval before clicking the “next” button.

Note: You must type the correct personal information to successfully in Wise loan login to the website

Reviews on Wise loan app and feedback

Wise loan reviews is rate 4.5 on App store by users.

I have a Wise loan, and I’m happy with the service as a whole. I was accepted for a loan within a few days of filling out the application, which was quick and easy.

The interest rates are good, and I like that there are no fines for paying off the loan early. I also like that I can pay online or with an app on my phone with Wise loan promo code.

Customer service isn’t always the best, which is a bad thing. I’ve had to call and wait on hold for a long time a couple of times.

You can view some following comments to know what customers think of:

To know whether Wise loan safe or not, watch the following video:

Wise loan loan repayment

You can pay back a Wise loan over the phone or by mail.

#1. Phone payment

- Step #1: Call Wise Loan at (800) 516-7840.

- Step #2: Tell the person in customer service your account number and how much you want to pay.

- Step #3: Pay by credit card, debit card, or bank account.

#2. Mail payment

- Step #1: Make your check or money order out to: “Wise Loan”.

- Step #2: Put your account number and the amount you’re paying on the check.

- Step #3: Mail your payment to Wise Loan, P.O. Box 101265, Fort Worth, TX 76185

Compare Wise loan to other lending companies

| Criteria | Grace Loan Advance | Wise Loan | Best Egg Loan |

| Minimum credit score | 300 | 200 | 640 |

| Loan amount | $1,000 – $35,000 | $2,00 – $20,000 | $2,000 – $40,000 |

| APR | 5.99% -35.99% | 5.99% – 35.99% | 6.99% – 36.00% |

| Loan term | 1 – 72 months | 24 – 60 months | 36 – 60 months |

| Funding time | 1 – 2 business days | 2 – 7 business days | 1 – 7 business days |

| Effectiveness | Good for borrowers with bad credit | Good for borrowers with fair credit | Good for borrowers with good credit |

Sources: Refer to FED reporting and research.

Wise loan customer service

To reach out to Wise loan, you can contact via the following way:

Phone Numbers:

- Customer Care Line (800) 516-7840

- Customer Care Fax (800) 564-1952

Customer Support Hours:

- Monday-Friday (Office) 9 a.m. – 6 p.m. CT

- Saturday (Office) 7 a.m. – 4 p.m. CT

- Sunday (Office) 9 a.m. – 5 p.m. CT

- Online Availability 24/7 (existing customers login here)

Corporate Mailing Address:

- P.O. Box 101265

- Fort Worth, TX 76185

Email us at: hello@wiseloan.com

Read more:

FAQs

Following the next FAQs about Wise Loan for more details:

Is Wise Loan legit?

Yes, Wise Loan is a legal way to borrow money online. People with bad credit can get personal loans that are paid back over time. Wise Loan works in a number of states in the US, and each state has given it a license to do business.

Is Wise loan a direct lender?

Wise Loan does not give money directly. They are an online site for lending that connects people who want to borrow money with a network of direct lenders. This lets them offer borrowers a wide range of loan choices and rates that are competitive. Making the process of applying for a loan easy and quick for borrowers.

In Conclusion

Some borrowers have reported having favorable experiences with Wise Loan, while others have complained about the company’s excessive interest rates and hidden costs. The reviews can be found on many websites online.

Before submitting an application for a loan, you should make sure you have thoroughly studied the lender’s terms and conditions. This lender is reputable and trustworthy, but you should still take the time to do so.

Leave a Reply