If you’re looking for Best Egg loan reviews, you’re in the right place.

In this comprehensive review at ktktld.edu.vn, we’ll cover everything you need to know before making a decision.

We’ll dive into the legitimacy of the company, discuss payment options, and explore the interest rates you can expect.

Let’s stay tuned!

Contents

- 1. Summary of Best Egg Loan

- 2. What is Best Egg loan?

- 3. Pros and cons of Best Egg loans

- 4. Best Egg interest rate

- 5. Example of Best Egg loan calculation

- 6. Best Egg personal loan requirements

- 7. Best Egg loan Amounts

- 8. Guide to register Best Egg loan Step-by-step

- 9. Reviews on Best Egg loan

- 10. Best Egg loan repayment

- 11. Compare Best Egg vs Lending Club

- 12. Best Egg loan customer service

- 13. FAQs

- 14. In Conclusion

1. Summary of Best Egg Loan

| ✅ How To | ⭐ Borrow Money From Cash App |

| ✅ Requirements | ⭐ A minimum credit score of 600 |

| ✅ Guide to | ⭐ Register for Best Egg loan |

| ✅ Loan amount | ⭐ $2,000 – $50,000 |

| ✅ Pros | ⭐ Wide range of loan amounts |

| ✅ Cons | ⭐High origination fees |

| ✅ Term | ⭐ 3 – 5 years |

| ✅ Phone number | ⭐ 1-855-282-6353 |

| ✅ Effectiveness | ⭐ Pretty Good |

2. What is Best Egg loan?

Best Egg loan is a personal loan option offered by Cross River Bank. It is a fixed-rate loan that allows borrowers to consolidate debt, finance home improvements, or cover other expenses. Best Egg loans have terms ranging from 3 to 5 years, and borrowers can receive loan amounts up to $50,000.

3. Pros and cons of Best Egg loans

Best Egg is an online lender that offers personal loans to borrowers with fair to excellent credit.

Pros

Best Egg personal loan provides its customers with some of the following benefits:

- This lender offers personal loans between $2,000 and $50,000, which is more than many other online lenders.

- It offers both unsecured and secured personal loans. Unsecured loans are not backed by collateral, while secured loans are backed by an asset, such as a car or a home.

- If you use a Best Egg loan to consolidate debt, this lender can make direct payments to your creditors on your behalf. This can save you time and hassle.

- You can prequalify for a its loan without affecting your credit score. This is a good way to see how much you might qualify for and what your interest rate might be.

- The application process for a its loan is quick and easy. It takes only a few minutes to apply online.

Cons

However, Best Egg loan consolidation also brings many drawbacks, including:

- This lender charges origination fees on all its loans. The origination fee ranges from 0.99% to 8.99%, which is higher than many other online lenders.

- It does not offer rate discounts for things like setting up autopay or making a large down payment.

- The lender does not offer a mobile app to manage your loan. You can only manage your loan online or by phone.

- The company is not available in all states. You can check its website to see if it is available in your state.

4. Best Egg interest rate

The interest rates for Best Egg student loans range from 8.99% to 35.99% APR. The interest rate you qualify for will depend on your credit score, income, and other factors.

You need a minimum credit score of 600 to qualify for a Best Egg personal loan, but you’ll need a minimum credit score of 700 and an annual income of at least $100,000 to get the best rates.

In addition to the interest rate, Best Egg also charges an origination fee on its personal loans. The origination fee ranges from 0.99% to 8.99% of the loan amount. The origination fee is deducted from the loan proceeds when you’re funded.

5. Example of Best Egg loan calculation

Here is an example of a Best Egg lending loan calculation:

- Loan amount: $20,000

- APR: 10%

- Term: 3 years (36 months)

- Origination fee: 2%

Monthly payment:

- (Loan amount * APR) / (12 * term) + origination fee / loan amount = (20,000 * 0.10) / (12 * 36) + 0.02 / 20,000 = $55.56

Total interest paid:

- (Loan amount * APR) * term / 1200 + origination fee = (20,000 * 0.10) * 36 / 1200 + 0.02 = $3,030.00

In this example, the borrower would have a monthly payment of $55.56 and would pay a total of $3,030.00 in interest over the life of the loan.

Please note that these are just estimates and your actual interest rate, monthly payment, and total interest paid may vary depending on your credit score, loan amount, and term.

You can use Best Egg’s personal loan calculator to get a more accurate estimate for your specific situation.

6. Best Egg personal loan requirements

To apply for a Best Egg loan, you need to meet the following requirements:

- Have a minimum credit score of 600 to qualify for a Best Egg personal loan. However, you’ll get the best rates with a credit score of 700 or higher.

- Your debt-to-income ratio (DTI) must be 40% or lower to qualify for a Best Egg personal loan. If you have a mortgage, your DTI can be up to 65%.

- Have a minimum annual income of $50,000 to qualify for a Best Egg personal loan. However, your income requirements may be higher if you have a lower credit score or a higher DTI.

- Get employed full-time for at least 2 years to qualify for a Best Egg personal loan.

- Possess a legitimate U.S. address and be a citizen or permanent resident of the country

- Own a checking or savings account within the United States.

7. Best Egg loan Amounts

The maximum loan amount you can borrow from Best Egg depends on your state and credit score.

- In general, you can borrow between $2,000 and $50,000.

- However, residents of Massachusetts have a minimum loan amount of $6,500; Ohio, $5,000; and Georgia, $3,000.

8. Guide to register Best Egg loan Step-by-step

To register for a Best Egg loan, follow these step-by-step instructions:

Step #1: Visit the Best Egg website

- Go to www.bestegg.com on your web browser.

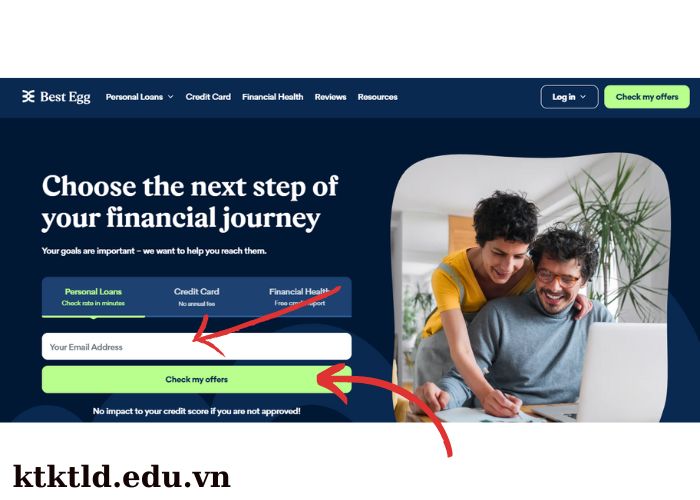

Step #2: Check your offers

- Press the “Personal Loans” tab.

- Then fill in your email address and click “Check my offers”

Step #3: Make a request

- Provide your amount needed and the reasons for loans.

- Then press “Continue” to proceed.

Step #4: Direct Pay

- Choose if you want to pay off directly. If you click “Yes”, then provide the direct pay amount.

- After that, tap the “Continue” button.

Step #5: Give your personal details

- Provide your name and birthdate.

- Next, press the “Continue” option.

Step #6: Supply your contact info

- Provide your address, and phone number.

- Hit the “Continue” button.

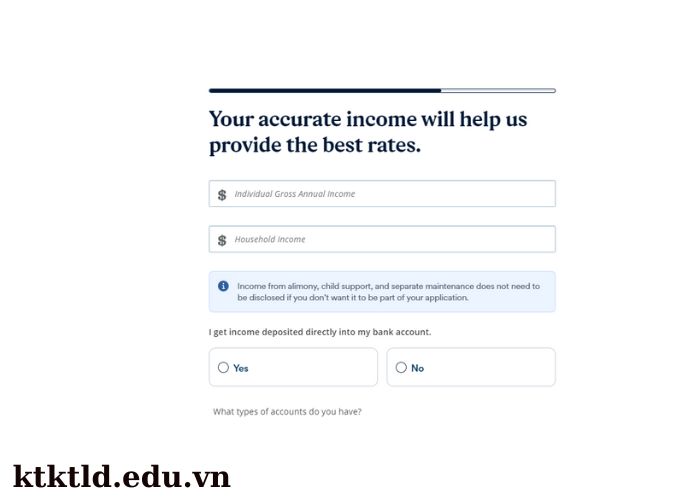

Step #7: Best Egg income verification

- Provide the information about your income and then press “Continue”.

- Following that, adhere to the remaining prompts on the website to complete registering for a loan.

9. Reviews on Best Egg loan

I have been a borrower of Best Egg loan for a few years. I needed to borrow money to consolidate my debt and improve my credit score.

I was pre-approved for a loan within minutes of applying online, and the whole process was very easy and straightforward. I received my funds within a week, and I’ve been making my payments on time ever since.

I’m very happy with my Best Egg loan. There are no unforeseen costs, and the interest rates are competitive. I also appreciate the fact that Best Egg offers a variety of loan terms to choose from, so I could find one that fits my budget.

You can see some customers’ Best Egg loan ratings and reviews as follows:

Furthermore, watch the following video to get more details:

10. Best Egg loan repayment

Here are the ways you can refinance your Best Egg loan:

#1. Online payments

- You can access the Best Egg loan login and make a payment using a credit card, debit card, or bank account.

- A one-time or regular payment schedule is also an option.

#2. Phone payments

- You can call Best Egg at 855-282-6353 to make a payment.

#3. Mail payments

- You can mail a check or money order to Best Egg at the following address: Best Egg, PO Box 207865, Dallas, TX 75320-7865

#4. Text payment

- Send the message “PAYNOW” to the phone number 28448 to pay your bills by text.

#5. Automatic payments

- This is the most convenient approach to ensure that you never miss a payment.

- Best Egg will automatically deduct your payment from your bank account on the same day each month.

You can also repay your Best Egg loan early without penalty. This can save you money on interest charges. To repay your loan early, simply contact Best Egg and let them know you want to make a lump sum payment or increase your monthly payments.

11. Compare Best Egg vs Lending Club

|

Criteria |

Best Egg | LendingClub |

|

Interest rates |

8.99% – 35.99% APR | 9.57% – 35.99% APR |

|

Origination fees |

0.99% – 8.99% of the loan amount | 3.00% – 8.00% of the loan amount |

|

Loan amounts |

$2,000 – $50,000 |

$1,000 – $40,000 |

| Loan terms |

3 to 5 years |

3 to 7 years |

| Credit score requirements | Minimum Best Egg credit score of 600, but 700+ for the best rates |

Minimum credit score of 660, but 720+ for the best rates |

| Effectiveness | Best Egg is generally more effective for borrowers with good credit. |

LendingClub is more effective for borrowers with fair credit. |

| Overall |

Both Best Egg and LendingClub are effective for borrowers with good to fair credit, but Best Egg may be a better option for borrowers with excellent credit. |

|

Sources: Refer to FED reporting and research.

12. Best Egg loan customer service

To contact Best Egg loan customer service, you can reach out to them through the following channels:

- Phone number: 1-855-282-6353

- Address: Best Egg, PO Box 42912, Philadelphia, Pennsylvania 19101

- Email: loan_assistance@mybestegg.com

Read more:

- Wise loan reviews

- 500 Dollar Loan

- Online Short Term Loans Direct Lender

- $1000 Quick Loan No Credit Check

- Grace Loan Advance review

13. FAQs

Here are some frequently asked questions about Best Egg loan:

Is Best Egg a good loan company?

Yes, Best Egg is a good loan company for borrowers with fair to good credit. They offer competitive interest rates and flexible repayment terms, and their application process is quick and easy. However, they do charge an origination fee, so be sure to factor that into your overall cost when comparing lenders.

Is Best Egg a reputable company?

Yes, Best Egg is a reputable company. It is a lending marketplace that offers personal loans to borrowers with good to excellent credit. This lender is backed by two FDIC-insured banks, Cross River Bank and Blue Ridge Bank. It is also a member of the Consumer Financial Protection Bureau.

Is Best Egg legit?

Yes, Best Egg is a legitimate company. It is an online lender offering personal loans to borrowers with fair to good credit. It has an A+ rating from the Better Business Bureau and a 4.6-star rating on Trustpilot. The company has been in business since 2014 and has funded over $5 billion in loans.

How long does Best Egg take to approve a loan?

Best Egg typically takes 1-3 business days for approval process to a loan application. Once approved, the funds are typically deposited into your bank account within 1 business day. So, if you apply for a loan today, you could have the money in your account by the next fourth day.

14. In Conclusion

The Best Egg loan Reviews seem to have a positive reputation, with users experiencing legitimacy in the borrowing process.

Feedback indicates that Best Egg offers competitive interest rates, making it an attractive option for borrowers.

Additionally, customers have reported satisfactory payment experiences, with the company providing a user-friendly platform for managing loan repayments.

These factors, combined with the potential for repeat borrowing in 2025, make Best Egg a reliable and convenient choice for individuals seeking a loan solution.

Oh, I can borrow up to $50,000 with Best Egg loan.

I am about to borrow the Best Egg personal loan to pay rent to my house.