Digido loan App review is legit or not? Harassment? Interest rate? Complaints? How to Payment gcash? Customer service?

Refer to detailed instructions on how to apply for a Digido reviews loan in the article compiled by ktktld.edu.vn below.

TOP 10 Legit Online Loan In Philippines – Only National ID required

Updated 04/2025

(Online Application)

#1

|

||

#2

|

||

#3

|

||

#4

|

||

#5

|

||

#6

|

||

#7

|

||

#8

|

||

#9

|

||

#10

|

Contents

- Digido loan overview

- What is Digido?

- Benefits of Digido loan app

- Cons of Digido Loan

- Digido interest rate

- Specific Example of Digido calculator

- Digido Loan App Requirements

- How can I get Digido loan application

- Digido Loan Reviews: What customers say?

- Digido payment

- Digido Loan App Philippines vs Finbro: Which is better?

- Digido customer service in Philipinnes

- Additional Questions About Digido Loan App in Philippines

- In short

Digido loan overview

| ✅ Digido loan App Review | ⭐ 4,6 stars |

| ✅ Guide to | ⭐ Apply online to Digido App |

| ✅ Loan amount | ⭐ 1000 – 25.000 Pesos |

| ✅ Age | ⭐ 21 – 70 years old |

| ✅ Term | ⭐ 3 – 6 months |

| ✅ Interest rate | ⭐ 0 % for first time |

| ✅ Requirements | ⭐ National ID |

| ✅ Pros | ⭐ legit lending company, partial payment, fast disbursement |

| ✅ Cons | ⭐ Have late payment fee |

| ✅ Evaluate the effectiveness | ⭐ Good |

| ✅ Bad dept | ⭐ Allow |

| ✅ Complaints | ⭐ No |

| ✅ Digido App dowload APK: | ⭐ Link Here |

| ✅ Hotline, Contact number | ⭐ (02) 8876-84-84 |

| ✅ Harassment | ⭐ By phone, email |

| ✅ Sec registered | ⭐ Yes |

What is Digido?

Digido is one of the first 24-hour online loan in the Philippines to help customers get a fast loan without complicated document requirements. Just sitting at home with 1 phone with internet connection, you can also borrow up to 30000 pesos, installments from 3 to 6 months. For new customers applying for a loan for the first time, they will be able to borrow up to 10000 pesos in 7 days.

Benefits of Digido loan app

Digido loan app is the perfect choice for customers’ financial needs with advantages such as:

- You can apply for a loan right on your computer or mobile phone, just need an internet connection. The registration process is simple and convenient, and does not take too much time.

- Available 24/7, regardless of weekdays, weekends, or even during public holidays.

- With just a valid ID, you can proceed with the loan process without having to deposit assets, without a guarantor, and without proof of income, giving you easy access to financing.

- The automated approval system ensures objectivity and reliability.

- The loan approval rate is more than 90%, providing great financial support opportunities for borrowers.

- Commitment with no hidden fees, no upfront fees. You will only pay the exact amount agreed, without any surcharges.

- Loan payment is extremely flexible, with a variety of payment methods for you to choose from according to your individual situation and desires.

- Customer information is strictly confidential, ensuring that all transactions and personal data are securely protected.

Cons of Digido Loan

Despite its many advantages, Digido online loan app also has some disadvantages to consider:

- The loan limit is not too high, it is a good choice for large capital needs or large-scale investment projects.

- Installment terms in Digido Philippines are usually quite short, which can put financial pressure on borrowers.

- Interest rates are higher than traditional loan service, especially for those with poor credit records.

Digido interest rate

Digido cash loan applies an average interest rate of 11.9% per month, and the maximum annual interest rate (APR) is 143%. To encourage and support new customers, Digido interest rate in the Philippines offers only 0% on the first loan within 7 days.

This is a good opportunity for customers to experience the service without worrying about interest rates.

Specific Example of Digido calculator

If you apply for a loan of 10000 pesos for 2 months, the interest rate is 12% / month. Digido’s loan calculator is as follows:

- The principal amount to be paid monthly is 5000 pesos.

- The amount of interest payable monthly is 10000 x 12% = 1200 pesos.

- The total amount payable for 1 month is 6200 pesos

Digido Loan App Requirements

To be able to apply for a loan from Digido Loan, you need to meet some basic conditions:

- Be a Filipino citizen between the ages of 21 and 70 years old.

- To ensure the ability to repay the loan on time, you need to have a stable source of income and be able to pay off the loan.

- Have a valid Government issued ID such as ITR, COE, DTI, company ID..

Digido first loan

Customers applying for a Digido installment loan for the first time only need to fill in their personal information in the loan application form of Digido website and upload a photo of the owner’s ID to verify the information.

Digido 2nd Loan

To apply for a Digido 2nd loan in the Philippines, simply log into the registered account for the first time and select the loan amount. If the payment is on time and reputable, Digido reloan will be approved immediately.

How can I get Digido loan application

Here is a detailed guide on the application and loan process from Digido Loan:

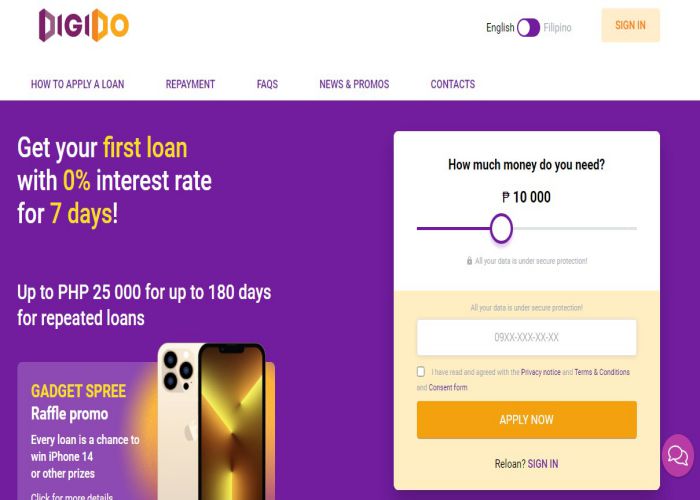

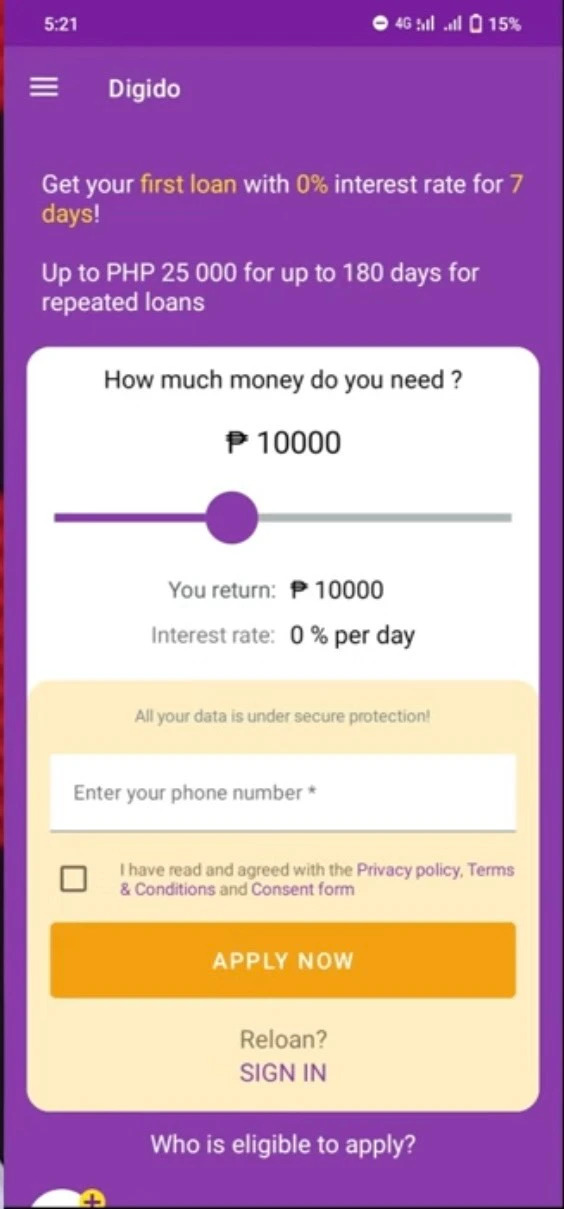

Step #1: Visit Digido’s homepage

- Visit the main Digido website or Digido Appstore Download: [table “digido_ph3” not found /]

- The borrower selects the desired loan limit.

- Enter your contact number and agree to the terms and conditions by selecting “Apply Now”.

- Those who have had a loan account before select “Sign in”.

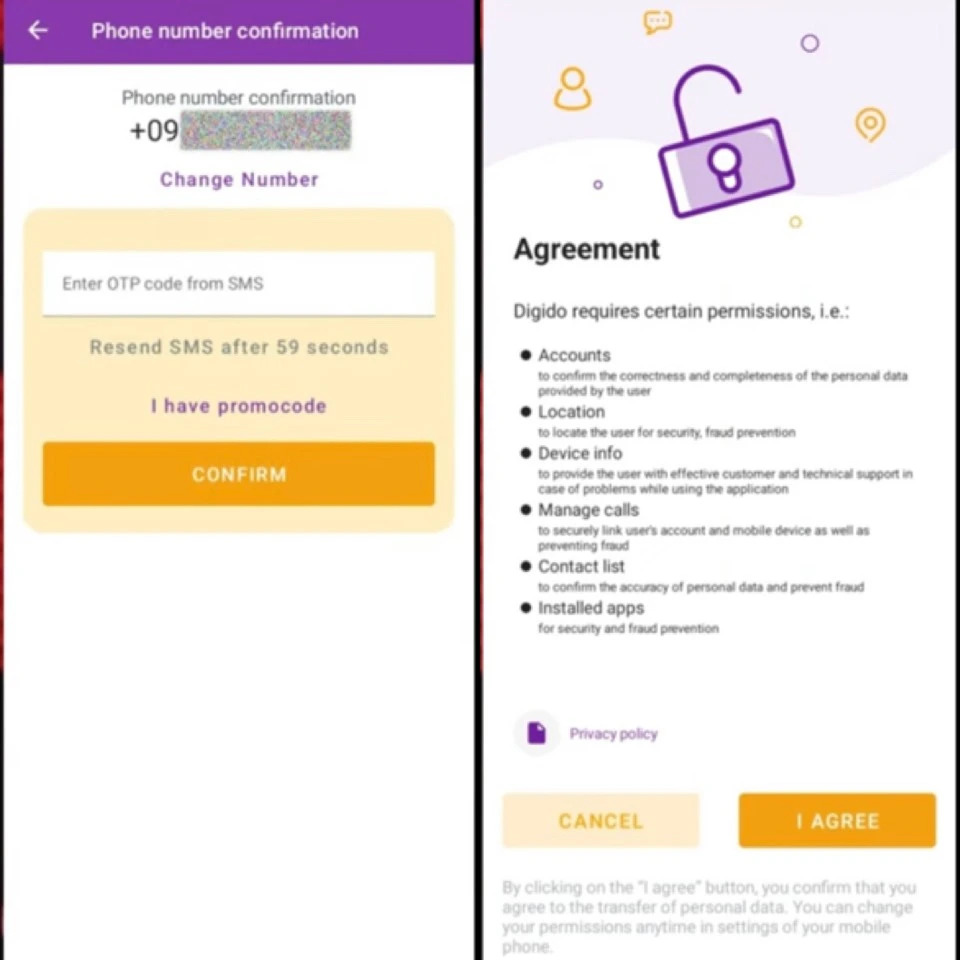

Step #2: Confirm your phone number and agree to the terms

- Digido will send an OTP (one-time authentication code) to the phone number you just registered.

- Enter the OTP to verify the phone number.

- Read the terms and conditions carefully before borrowing. If you agree, select “I Agree”.

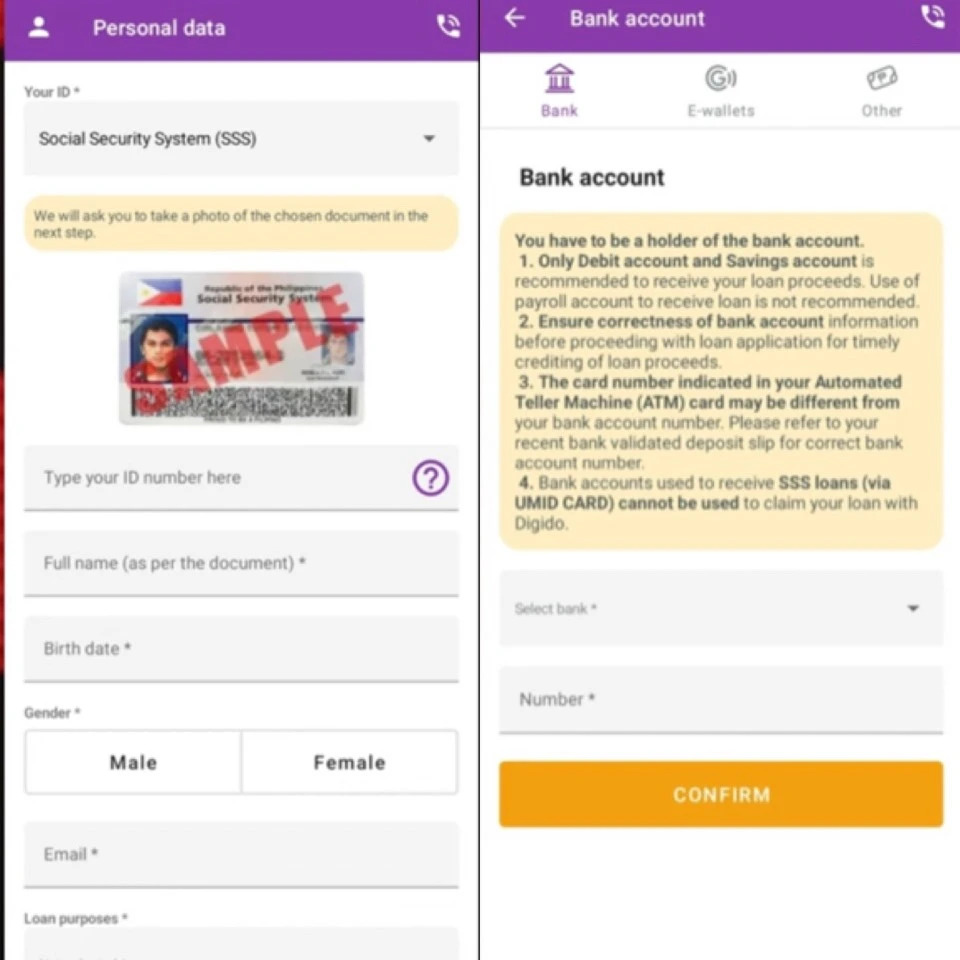

Step #3: Register your personal information

- Complete and accurate the requested personal information, including full name, date of birth, email address, permanent address, personal ID information, job information, and reference.

- Provide information about your bank account or e-wallet to receive a loan and make payments.

- Upload a photo of your personal ID to verify your personal information

Step #4: Wait for approval and disbursement

- The system will proceed with automatic approval within 5 minutes.

- Digido disbursement quickly on the same day. The loan amount will be transferred to the bank account or e-wallet you registered earlier.

Read more: How to delete Digido Account?

Digido Loan Reviews: What customers say?

Digido Loan is not only a financial service, but also a trusted friend in helping you solve situations that need money easily, quickly and conveniently.

Digido payment

Customers have many options to make payments for Digido partial Payment loans, including:

- Make partial loan payments via bank transfer to the account number provided.

- Use online banking services from banks such as Union Bank, BDO, BPI, China Bank, Maybank, Landbank, Metrobank, PSBank.

- Pay in cash at Partners payment points such as 7-Eleven, ECPay, Robinsons, Savemore.

- Use Coins.ph e-wallet or Cebuana Lhuillier service to make payments.

Read more: how to pay Digido using Gcash

Digido Loan App Philippines vs Finbro: Which is better?

| Criteria | Digido App | Finbro PH | Unacash App |

| Limits | 500 – 30000 peso | 1000 – 50000 peso | 1000 – 50000 pesos |

| Interest | 0,4%/day | 0,5% – 1,25%/day | 2 – 6 months |

| Tenor | 3 – 6 months | 1 – 12 months | 0% – 16%/months |

| Age | 21 – 70 years old | 20 – 65 years old | Over 18 years old |

| Browsing time | 5 minutes | 15 minutes | 15 minutes |

Sources: Refer to Sate Bank reporting and research.

Digido customer service in Philipinnes

Digido contact number in Philipinnes:

- Sister company: Digido Finance Corp.

- Branches: No

- Digido website: https://digido.ph/

- Support Digido Ph: (02) 8876-84-84

- Address: Units P107003R, P107007R, P107008R, Level 7 Cyberpark Tower1, 60 Gen. Aguinaldo Ave., Cubao, Quezon City, Philippines 1109

Additional Questions About Digido Loan App in Philippines

Here are some frequently asked questions about Digido loans:

is Digido legit or not?

Digido is a financial service that operates completely legally in the territory of the Philippines. Digido is approved and regulated by The Securities and Exchange Commission – SEC and National Bank of the Philippines. Customers can feel secure and confident when using Digido to meet their financial needs quickly and effectively.

Is Digido SEC registered?

Digido has received certification from the Securities and Exchange Commission (SEC) with SEC registration number CS202003056 and authority certificate number 1272. This means that lending at Digido meets legal requirements and is recognized by government authorities, ensuring transparency and fairness in financial transactions between Digido and customers.

Does Digido do field visit?

Digido does not perform in-person and on-site due diligence. The process of determining loan approval will be based on the borrower’s credit history, registered personal information and assistance from the automated approval system. Therefore, if customers are late in payment or Digido unpaid loans will incur high interest penalties, be bothered by Digido harassment.

In short

If you need to solve personal work urgently, customers can refer to Digido online loan service. It is a fully legal financial service, capable of lending up to 30000 pesos and has a 7-day full interest-free offer for first-time borrowers.

Rated 5 stars if the article was helpful. Any questions you can leave a comment, we will answer as quickly as possible.

Leave a Reply