Asteria Lending is a financial company that has nearly 10 years of operation in the Philippine market. Customers just need to register online right on their phone to receive up to 50,000 pesos with an interest rate of only 0.2%/day.

See more Asteria Lending information review compiled by ktktld.edu.vn in the article below.

Contents

- What is Asteria Lending?

- Pros of Asteria Lending

- Cons of Asteria lending Philippines

- Asteria Lending interest rate

- Example of Asteria Lending calculation

- Asteria Lending Philippines requirements

- Guide to register Asteria Lending Philippines application Step-by-step

- Reviews Asteria Lending feedback

- Asteria Lending repayment

- Compare Asteria Lending Philippines with others

- Asteria Lending customer service

- FAQs

- In conclusion

What is Asteria Lending?

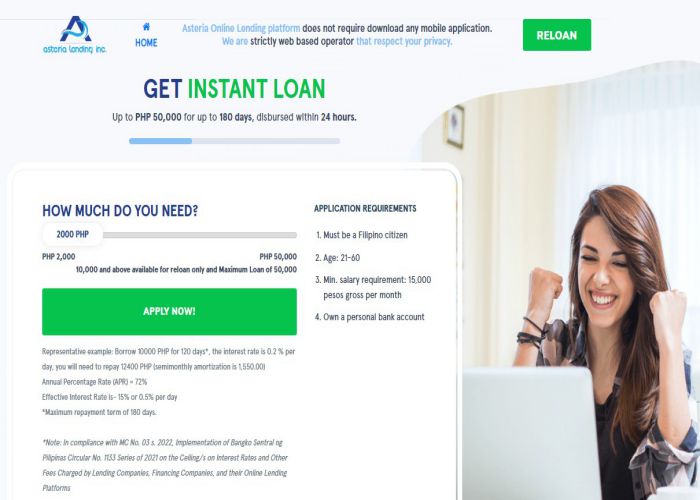

Asteria Lending is a reputable financial company in the Philippines, operating since 2016, registered with the SEC and certified to operate legally. The company provides personal loans and salary loans to provide financial support to Filipinos in the form of online registration with limits from 2,000 to 50,000 pesos, repayment terms from 30 to 120 days.

Pros of Asteria Lending

Asteria Lending review has many advantages such as:

- Operating legally, SEC registration number: CS201603853.

- Online registration is easy, safe and convenient, completed in just 3 minutes.

- No need to prove income, no collateral, just a valid ID.

- Automatic approval within 24 hours, disbursement immediately after loan approval.

- Flexible payment, payment time can be extended.

- Absolute privacy policy for personal information.

Cons of Asteria lending Philippines

Asteria Lending review has the following disadvantages:

- New customers can only borrow a maximum of 10,000 pesos.

- Short-term loan period.

Asteria Lending interest rate

Asteria Lending applies an average interest rate of 0.2%/day, and a late payment fee of 5%. First-time borrowers can borrow a maximum of 10,000 pesos. Recurring loans with creditable payments can be up to 50,000 pesos. Payment term 30 days – 61 days – 75 days – 90 days or 120 days.

Example of Asteria Lending calculation

Asteria Lending Ph Approval 30,000 for 90 months with interest rate of 0.2%/day.

- The amount of interest payable after 90 days is 30,000 x 0.2% x 90 = 5,400 pesos.

- Total amount payable after 90 days is: 30,000 + 5,400 = 35,400 pesos.

Asteria Lending Philippines requirements

Conditions for applying for an Asteria Lending loan are:

- Filipino citizens, living and working in the areas of Batangas, Metro Manila, Quezon, Pampanga, Blcol and some neighboring cities.

- From 21 to 60 years old.

- Minimum income 10,000 pesos/month

- Have at least 1 valid ID (driver’s license, Philhealth ID, TIN ID, UMID).

- Have an official bank account.

Guide to register Asteria Lending Philippines application Step-by-step

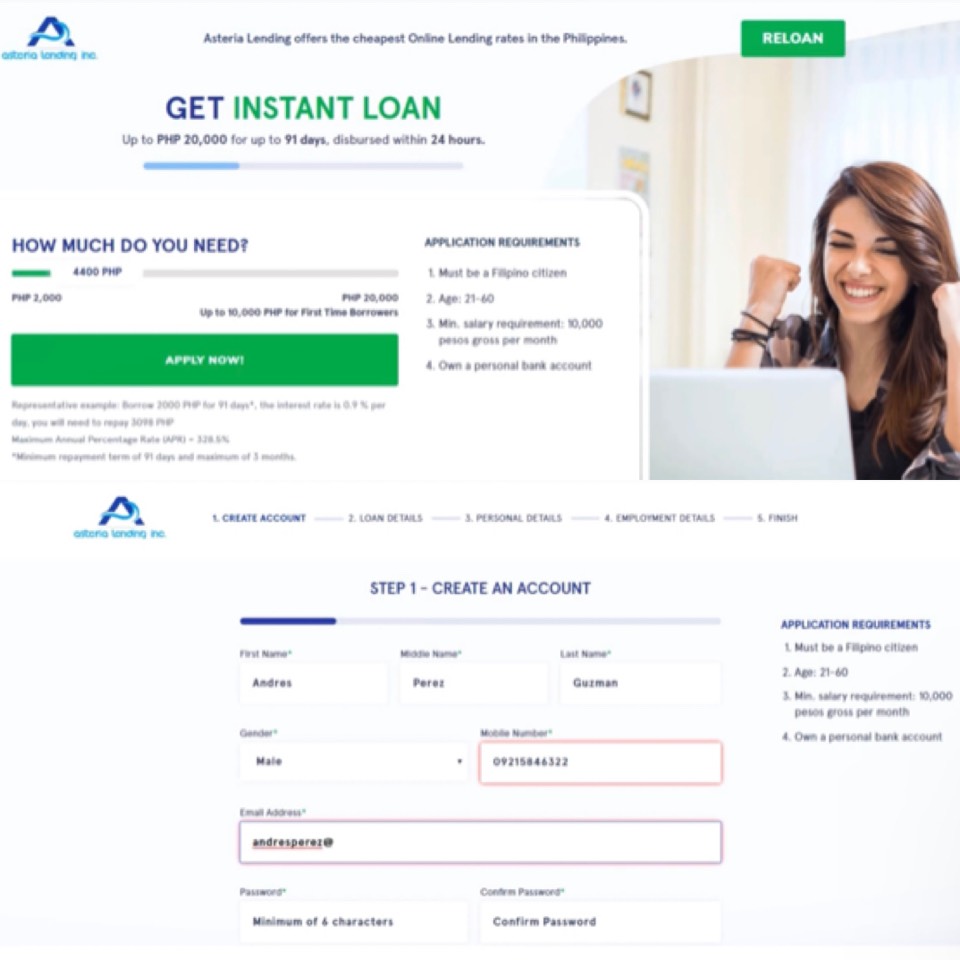

Instructions on how to apply for an Asteria Lending loan:

Step #1: Register a loan account

Choose the loan limit according to your needs. Apply now.

Fill in your full name, gender, phone number, email, password to create an account.

Step #2: Loan details

Type requested loan amount, choose loan type, choose loan term, type bank account.

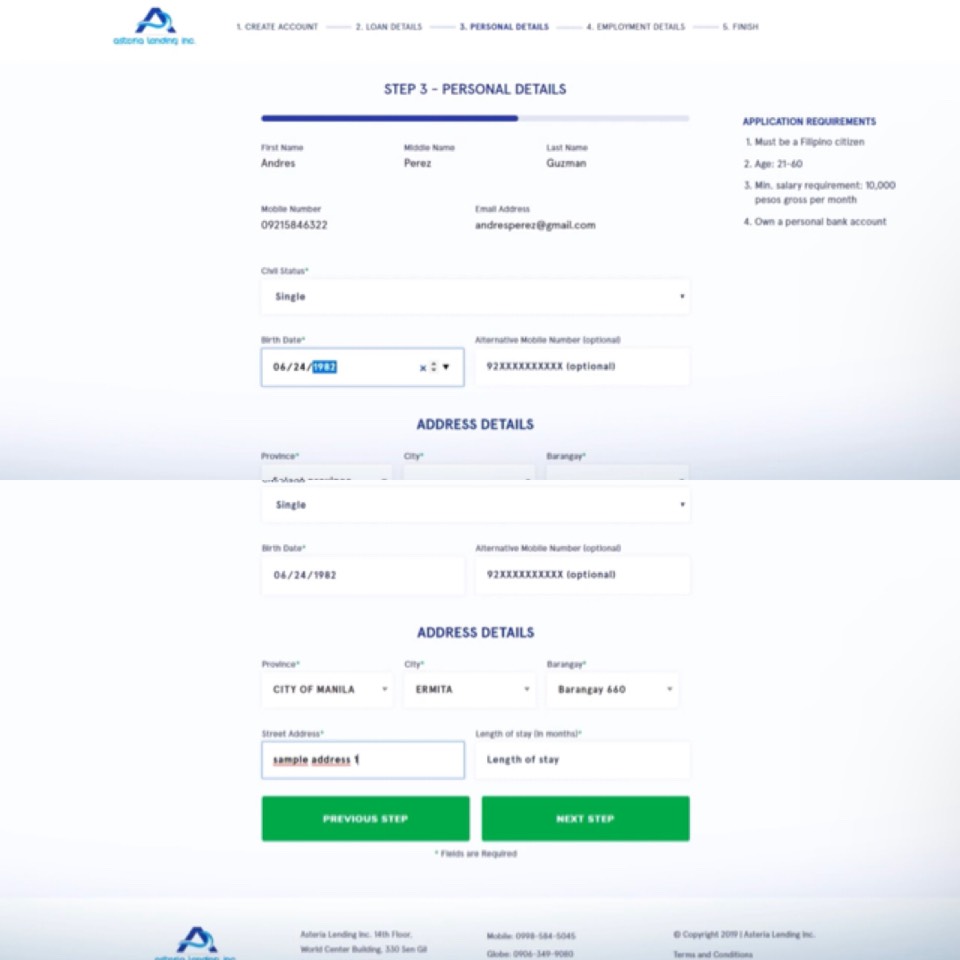

Step #3: Personal details

Write full name, phone number, email, marital status, date of birth, address, time of residence, alternative mobile number.

Step #4: Employment details

Fill in the company name, company address, form of operation, type of job, working hours, salary, pay date.

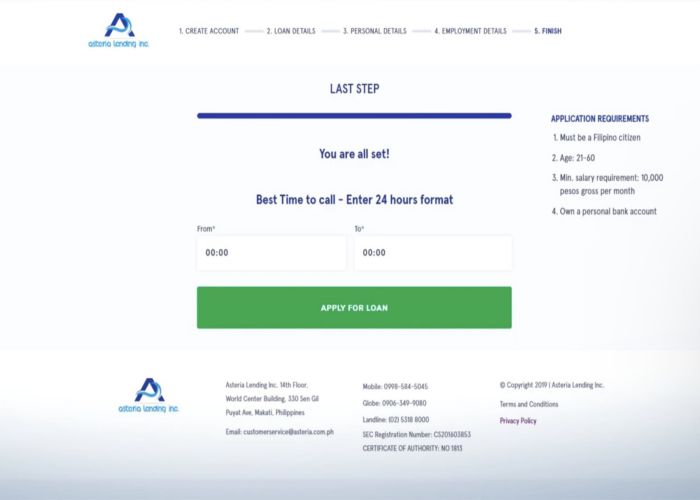

Step #5: Submit loan application

Choose the amount of time you can receive a confirmation call from the lender.

Submit a loan and wait for approval.

Reviews Asteria Lending feedback

Sumisho loan Philippines is rated 4 stars from customers with its flexible, safe, easy-to-borrow, and super-fast disbursement online loan service.

Asteria Lending repayment

Asteria Lending payment is flexible via Dragon Pay at payment points nationwide such as 7-Eleven, GCash, PayMaya, LBC, Bayad Center, Cebuana Lhuillier, Super Malls, Robinsons Malls.

You will receive an email with payment instructions, payment amount, and payment time after receiving loan disbursement.

Compare Asteria Lending Philippines with others

| Comparative criteria | Asteria Lending | Ansi cash loan | Eastwest personal loan |

| Limits | 2.000 – 50.000 pesos | 1.000 – 20.000 pesos | 25.000 – 2.000.000 pesos |

| Tenor | 30 – 120 days | 91 – 180 days | 12 – 36 months |

| Interest | 0,2%/day | 0,09%/day | 1,79%/month |

| Age | From 21 to 60 years old | From 18 to 60 years old | From 21 to 65 years old |

| Browsing time | 24 hours | 10 minutes | 2 – 3 days |

Sources: Refer to Sate Bank reporting and research.

Asteria Lending customer service

Asteria Lending Ph complaints are received through contact channels such as:

- Address: Unit 305 3/F 6762 National Life Insurance Bldg. San Lorenzo, Ayala Ave. Makati City, Philippines.

- Email: customerservice@asteria.com.ph

- Hotline: 0919.084.8290 – 0919.084.8276

- Landline: (02) 5318 8000

- Office hours: Mondays to Fridays, from 9AM to 7PM.

FAQs

Below are some frequently asked questions about Asteria Lending loan service:

Is Asteria Lending legit?

Yes. Asteria Lending Inc is a financial company operating since 2016. The company has registered with the SEC with SEC Registration Number: CS201603853 and Certificate of authority No: 1813. With nearly 10 years of experience in the market, Asteria company has provided financial support. for over 100,000 customers, just register online and receive money in 24 hours.

Is Asteria Lending harassment?

No. Asteria Lending is considered one of the leading reputable financial companies in the Philippine market. All operational information, contact information, and loan information are public and transparent. Customers who have used Asteria’s online loan service confirm that the lender has not taken any action to harass customers.

How to make Asteria Lending complaints?

For any questions or complaints about Asteria Lending’s services, customers can visit the company’s official website, in the Contact us section, leave a message with name, email, and phone for quick support. In addition, borrowers can contact directly at hotline (02) 5318 8000 or send an email to customerservice@asteria.com.ph. from Monday to Friday, 9AM to 7PM.

In conclusion

Asteria Lending is a reputable, legally operating financial company, providing 2 online cash loan packages: salary loan and personal loan. You can receive money the same day, up to 50,000 pesos, for up to 120 days

Rated 5 stars if the article was helpful. Any questions about Asteria Lending you can leave a comment on, we will answer as quickly as possible

Leave a Reply